Contact Us Now ! 1-844-245-5633

Integrity Practice Solutions – A Professional Medical Billing Company.

Our Revenue Cycle Management (RCM) lifecycle runs from Patient Insurance Verification to Reporting and thoroughly covers each aspect of Medical Billing to make sure our providers get paid appropriately on each and every claim.

Our team will access the appointment screen of your Practice Management System / EHR and run Insurance Eligibility Check on all patients with booked appointments. If there are any issues, they will alert the office staff so they can handle it when the patient comes for their visit.

The provider will complete the encounter sheet/superbill after the patients visit. They can do this directly into the EHR or on a paper superbill. The office staff will scan the paper superbill to our secure website portal. They will also scan the Patient’s Insurance Cards into their Practice Management System or make copies of them and scan to our secure website or fax it to our office.

Our staff will go over the scanned documents and update the Patient Demographics in the billing software. They will recheck the insurance information and communicate with the office any issues that they encounter.

We will go over all the appointments in your practice management system or signup sheet and compare them with the superbills / encounters we have received. If there are patients on the appointment that was checked-in but we do not have superbills for, those will be communicated to the office.

We will enter all the charges in the billing system and scrub the claims for CCI edits, MUE edits, and our in-house scrubbing engine which can flag various issues before they reach the payor.

All claims will be sent to a Clearing-house (e.g. Availity, Optum, Ability, Trizetto, etc.) depending on the billing software. They will further scrub the claims and any reports that come back will be worked on right away so there is no delay in claims reaching the payors.

We Sign-up the practices for Electronic Remittance Advice (ERA) and Electronic Fund Transfer (EFT) so that all checks are deposited directly into the banks and all EOB’s are received electronically. If there are any paper EOB’s, they will be mailed to the office and the staff will scan them to our secure portal. Our staff will post all EOB/ERA and work on any denials or low payments right away.

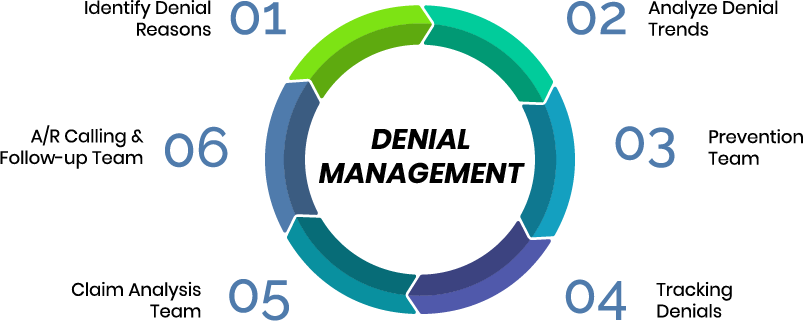

Any denials that come up are worked on right away. The staff will analyze why the denial happened and take corrective steps of updating the information and re-submitting the claims or calling the insurance and having them reprocess the claims. Insurance companies bank on the fact that many providers will not do that since it requires hours and hours on the phone with them. We do not let them get away with that!!!

Our staff goes over all claims that were sent 30 days prior. T-30 as we call it. They will go over every claim paid or unpaid to make sure there is none left behind. Even after sending a claim, insurance might claim they never received it and the only way to fight that is to know which one is your stragglers.

All our employees have deep knowledge of MS Excel and related spreadsheet software. Billing systems can claim to have powerful reporting but nothing beats running multiple reports, pivots etc. to get to exactly the information that you need. Every practice gets the reports and KPI’s they use to run their business.